Whitechurch Investment Update: Quarterly Review - Q1 2023

6th April 2023

Click here to download a PDF Version of the Quarterly Review

Welcome to the Whitechurch quarterly investment review. This review covers the key factors that have influenced investment markets over the past quarter and the Whitechurch Investment Team’s current views and broad strategies being employed.

We start this quarterly review by reflecting on the recent events in the banking sector. First to the US, where on March 10th, Silicon Valley Bank (SVB) – the 16th largest bank in the US – was shut down by regulators. SVB saw massive growth between 2019 and 2022, but its collapse was even more rapid, reflected in the fact that analysts were still giving the bank a ‘buy’ rating only days prior. During its growth years, SVB acquired significant deposits from start-up technology companies. SVB used these deposits to purchase Treasury bonds and other long-term debt. Fast forward to 2022, and the rapid rise in interest rates meant that these debt instruments declined significantly in value. At the same time, many of SVB’s customers were experiencing financial stress, and began to withdraw their funds accordingly. To cover these withdrawals, SVB was forced to sell some of its debt instruments at a significant loss (c.$1.8bn), a move which ultimately saw a run on deposits (customers withdrawing funds for fear of losing them) and the bank’s eventual collapse. SVB’s problems were exacerbated by the nature of its customer base, many of which were companies with deposits far in excess of the government deposit insurance threshold of $250k, though the US administration later confirmed it would honour all deposits held. Two days later, Signature Bank – the US’ 19th largest bank – also failed following a run on deposits. Like SVB, it had an abnormally large share of uninsured deposits.

Back on this side of the Atlantic, the troubles at SVB sent the share price of struggling Swiss bank, Credit Suisse, into free fall. Already beset by a long string of scandals, concerns were compounded when the Swiss lender announced that it had found ‘material weaknesses’ in its financial reporting procedures. The final nail in Credit Suisse’ coffin came, somewhat ironically, from its largest shareholder – Saudi National Bank – who confirmed that it could not provide any more funding for the ailing bank. Despite the announcement of a $54.2bn loan from the Swiss National Bank, investor confidence could not be restored. As a result, Swiss authorities brokered the banks emergency sale to UBS for three billion Swiss francs.

The collapse of SVB, Signature and the forced sale of Credit Suisse has naturally drawn comparisons with 2008/09 and the Great Financial Crisis (GFC). In our opinion, however, recent events are very different to 2008. For starters, in the wake of the GFC, regulators introduced much stricter regulations for banks. This included raising capital requirements to ensure that banks have adequate reserve levels to cope with a crisis. It is worth noting that SVB, due to its small size relative to America’s largest banks, was not subject to such stringent regulation – in part due to a law passed by Donald Trump during his time in office. Compared to SVB, which relied heavily on deposits from tech start-ups larger banks in the US and UK have much more diversified business models, helping to alleviate risk. In the case of Credit Suisse, its failure was essentially down to poor internal governance, rather than wider problems in the European banking sector. The upshot of this is that we do not see these leading to a repeat of 2008.

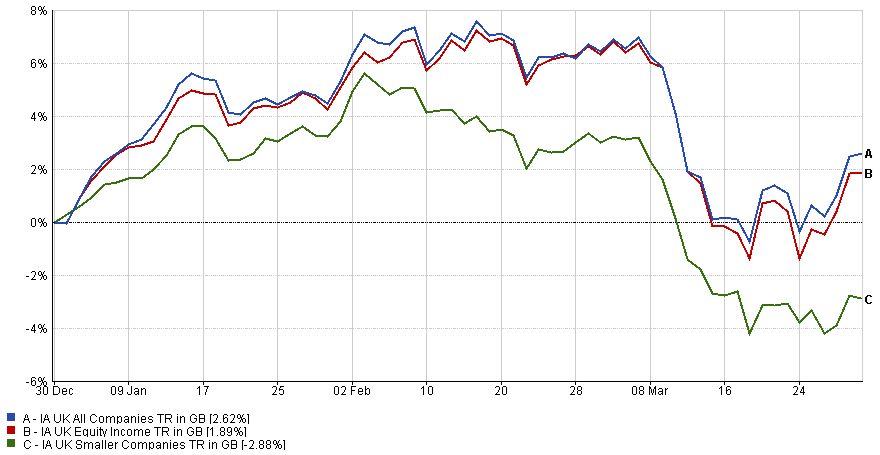

UK Equities

In what was another mixed quarter, UK equities started 2023 on a positive note, returning c.6% in January. Following a somewhat flat February, March saw a swift reversal in fortunes, with the UK market giving back almost all of its earlier gains. In a repeat of 2022, it was large-cap stocks which held up best, while their small-cap counterparts struggled. Despite the market slump in mid-March, the majority of sectors gained over the quarter, led by Consumer Discretionary (13.7%) and Industrials (9.8%). The notable laggard was Real Estate (-0.1%).

The year began with a strong rally for equity markets globally, buoyed by falling inflation, stronger than expected economic data, and hopes that central banks’ recent interest rate rises are nearing their peak. In the UK, January inflation came in at 10.1%, marking the third straight month-on-month decline. An uptick in economic data also hinted at a better-than expected outlook for the UK economy. Lagging data from the Office of National Statistics (ONS) showed zero gross domestic product (GDP) growth through the fourth quarter of 2022, meaning that the UK narrowly avoided a technical recession (defined as two consecutive quarters of negative GDP growth). Positive retail sales volume growth through January and February also hinted at a more resilient UK consumer, despite the ongoing cost-of-living squeeze.

Whilst broadly encouraging, a stronger-than-expected UK economy continues to prove a headache for the Bank of England (BoE), whose main aim of price control (i.e., reducing inflation) is likely to require a further economic slow-down. As expected, the BoE raised rates by a further 50 basis points (bps) at the beginning of February, moving the base rate to 4%. However, markets acknowledged the dovish (generally favouring lower future rates) tone of BoE governor Andrew Bailey’s announcement, as he stated that inflation had ‘turned a corner’.

March saw a sharp reversal in fortune for the UK market, with the turmoil in the US and European banking sectors sending jitters across global financial markets. UK aggregate equities fell sharply upon news of SVB’s collapse, led by financial institutions including banks and insurance firms. Further bad news was to come in the form of an upside inflation surprise, with February’s Consumer Price index (CPI) coming in ahead of consensus at 10.4%. In previous months, higher-than-expected inflation had typically driven fears of further hawkishness (favouring higher future rates) from the BoE. But with the upheaval in the banking sector (itself partly blamed on higher rates), analysts speculated that the BoE might pause its rate hiking cycle, or even reverse it. In the end, the Monetary Policy Committee (MPC) settled on a 25 bp increase, seemingly reaffirming the BoE’s commitment to tackling inflation above all else.

It is perhaps a sign of the volatile times that Chancellor Hunt’s spring budget is the last, rather than first, point of discussion this quarter. Setting a tone similar to previous statements, the focus was on attracting the unemployed back to the workforce and boosting business investment. Notable highlights included a 3-month extension to the government’s energy support scheme, the 30-hour free childcare allowance (for working parents) expanded to cover one and two year olds, and confirmation that the main rate of corporation tax is to rise from 19% to 25%. Accompanying figures from the Office for Budget Responsibility (OBR) predicted that the UK will avoid a recession in 2023 (though the economy will shrink overall), and that inflation will fall to 2.9% by the end of the year.

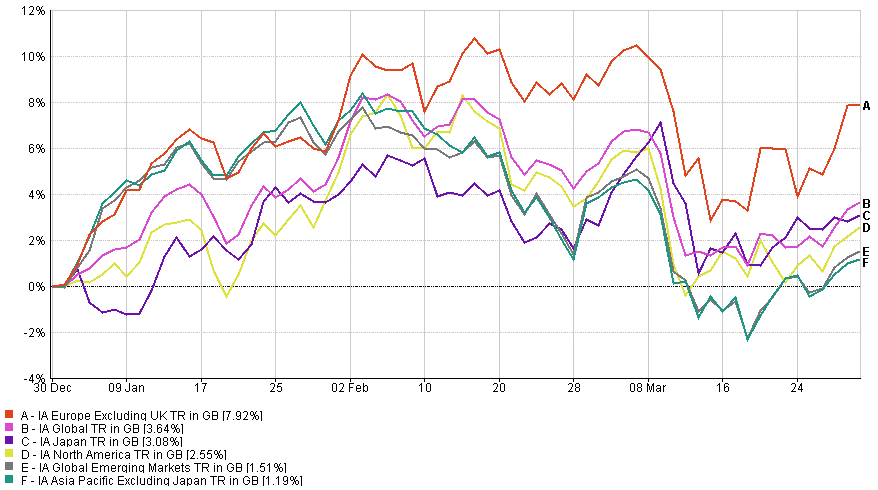

Global Equities

Despite the volatility in the global financial sector, all major regions registered positive returns through Q1. US inflation – which has now fallen for 8 consecutive months – remained a key driver of returns, particularly for developed markets. Whilst inflation remains high relative to long-term 2% target, markets remained hopeful that the declining trend means the Federal Reserve (‘the Fed’) is approaching the end of its rate hiking cycle.

Despite the prospect of a more dovish Fed, the US was the worst performing developed market over the quarter. Following a strong January in performance terms, and in spite of the broader downward inflation trend, January’s CPI reading (released in February) came in significantly above expectations at 6.4%. As my colleague Tim Jones has discussed in previous commentaries, the US remains stuck in a cycle of ‘good news is bad news’, whereby any positive economic data is forecast to drive higher inflation and hence, raise the prospect of higher future rates. The US job market continued to exceed expectations, with January’s non-farm payroll figure coming in three times higher than analyst’s forecasts. February’s unemployment rate crept up to 3.6% but remains near its 50-year low. In a widely anticipated move, the Fed raised rates by a further 25 bps in February. March was dominated by the failure of SVB (and Signature), prompting a sharp sell-off for US equities. Whilst the share price of larger US banks came under significant pressure, they simultaneously enjoyed a significant inflow of new deposits, as the customers of smaller banks sought the perceived safety of their larger peers. As in the UK, there was widespread debate amongst analysts regarding the Fed’s likely course of action in March, with some predicting a pause or even reversal of the tightening cycle. Despite these predictions, the Fed pressed on with a further 25 bp hike, seemingly reaffirming its commitment to tackling inflation above all else.

For the second consecutive quarter, European equities were the best performing of the major regions, with the flagship French and German indices returning 13% and 12%, respectively. Much of the recent news flow in Europe had been dominated by concerns around energy security, but one year on from Russia’s invasion of Ukraine, an exceptionally mild winter and effective sourcing of natural gas from other sources (predominantly liquified natural gas (LNG)) has helped alleviate some of those concerns. As I write this article and we enter the (hopefully!) warmer Spring months, European gas reserves sit at 55%, considerably higher than they were at this point in 2022 (26%). With supply concerns easing, European natural gas prices have fallen significantly, approaching the lows last seen in summer 2021. With the risk of a deep, energy-driven recession receding, economic data also picked up through Q1. In January, the Eurozone composite PMI (a common measure of business activity) returned to expansionary territory for the first time since September 2022, whilst February’s estimate was the highest since last May. Eurozone inflation fell through the quarter but remained significantly above the European Central Bank’s (ECB) 2% target. In response, the ECB raised rates by 50 bps in both February and March, in moves widely anticipated by the market.

Japanese equities returned low single digit gains through Q1. Like other developed markets, the Japanese economy is currently grappling with elevated inflation, though with a January inflation rate of 4.3%, the price increases suffered through Q1 were significantly below those of other developed regions. Back in late December, the Bank of Japan (BoJ) surprised the market by announcing that they were no longer averse to increasing the yields on long-dated government bonds. In January, it bought a record $182bn of these bonds in order to defend the new yield cap, highlighting the increasing difficulty the BoJ faces in sustaining its yield control policy in the face of above-target inflation. Towards the end of January, Q4 earnings season began on a broadly positive note despite input cost pressures. Domestic companies fared best, whilst exporters had a tougher time due to the appreciation of the Yen through Q4 2022. Companies operating in the retail, hotel and services sectors also benefited from a rebound in inbound tourism, with the number of foreign travellers returning to pre-COVID levels.

Chinese equities experienced another volatile quarter, which started with a continuation of Q4’s rally as markets continued to digest the end of China’s zero-COVID restrictions. On the 8th of January, almost three years on from its original enforcement, travellers entering the country were no longer required to undergo multiple COVID tests or quarantine upon arrival. Government measures to support the ailing real estate market, as well as an apparent easing of the regulatory crackdown on domestic technology companies, further improved market sentiment. The huge amount of excess savings accumulated during lockdown are expected to fuel an economic recovery driven by the services sector. This was reflected in the China Caixin Services PMI index, which rebounded to 55 in February. However, the Q1 rally proved short-lived, as rising geopolitical tensions and an element of profit taking saw the major Chinese and Hong Kong indices give up all and more of their January gains through February and into March. As in other markets, the mid-March collapse of SVB sent Chinese market indices sharply lower, led by financials. While fears of any contagion effect waned towards the end of the month, aggregate Chinese equities still finished the quarter fractionally in the red.

Unsurprisingly given China’s large contribution to the index (32% at time of writing), aggregate global emerging market equities largely tracked the fortunes of the region’s largest economy. Amongst the positive contributors through Q1 were Taiwan and South Korea, whilst energy exporting countries such as Saudi Arabia, Qatar and Dubai were mixed as investors mulled the impact of falling oil and gas prices. Brazilian equities were slightly lower as uncertainty over the pace of China’s reopening weighed on commodity exporters. The major detractor from the index was India. In late January, the Adani Group – one of India’s best known conglomerates, and whose chairman is a long-time ally of PM Modi – was engulfed in scandal, accused of stock price manipulation and fraud. Ongoing inflation and market valuation concerns also weighed on investor sentiment.

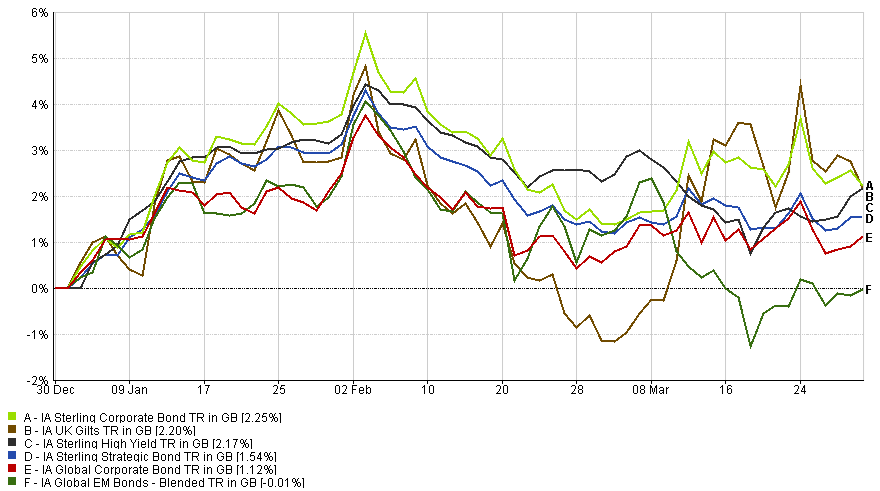

Fixed Interest

February saw a reversal in fortunes for the bond market, with a series of better-than-expected economic data reigniting fears of more hawkish central banks. In the US, the January non-farm payroll report (published in February) showed that the US added 504,000 new jobs over the month, versus analysts’ expectations of 185,000. A red hot labour market is now seen as one of the major roadblocks to lower inflation – the report suggested the Fed has some way to go in its fight against rising prices. Noting the jobs report, analysts at Deutsche Bank raised their US terminal rate forecast to 5.6%, from 5.1% previously. In the UK too, very strong wage growth (6.7% year-on-year to the end of January) hinted at a labour market not yet feeling the full effect of higher rates. Against this backdrop, sub-asset classes with lower interest rate risk (high yield, short-dated) outperformed their longer duration (more sensitive to changes in interest rates) counterparts, with UK gilts amongst the worst performers.

If there was any positive to be taken from the March collapse of SVB (and near-failure of Credit Suisse), it was that the crisis re-highlighted the diversification benefits of holding bonds within a multi-asset portfolio. While jitters in the banking sector saw a sharp sell-off across global equity markets, developed market bond indices rallied sharply, with investors taking the view that central banks would be forced to slow, stop or even reverse recent interest rate hikes in order to ease market fears. In the end, both the Fed and BoE voted through further rates rises of 25 bps, however this didn’t dampen the broader expectation that central bank tightening is now on borrowed time. Against this backdrop, the best performing assets were long duration, investment grade bonds – UK gilts were the best performing sub-sector, gaining 4.2% over the month, while the yield on the US 10-year Treasury fell by 45 bps to finish the quarter at 3.47%.

Commercial Property

Following heavy back-to-back losses in Q3 and Q4 of 2022, the UK commercial property sector finished Q1 on a more stable footing, finishing the quarter flat. As we have reported previously, sentiment towards the sector has been damaged by the prospect of higher borrowing costs, while the cost of living squeeze is expected to reduce consumer spend in areas such as retail. January started on a more positive note for the sector, before volatility in the wider equity market saw a sharp decline for listed Real Estate Investment Trusts (REITs) through February and March. While there is a growing sense that the interest rate cycle is close to peaking, the more challenging macroeconomic backdrop continued to weigh on both commercial and residential sectors. The release of the latest UK Commercial Property Survey from the RICS showed that 83% of respondents now consider the market to be in a downturn, with noteworthy drops in occupier demand for offices (-29%) and retail premises (-45%). Looking ahead, there is notable divergence in terms of future rental demand by sector (based on RICS member projections), with student housing, aged care facilities and data centres forecast to deliver the most resilient performance over the next 12 months.

Commodities

The aggregate composite commodities index was sharply lower through Q1 (-8.8%), as ongoing fears of a global recession weakened the demand forecast for most raw materials. Natural gas was the largest detractor from the index, declining over 50% (in sterling terms) over the quarter, as above-average European temperatures and ample inventories put significant downward pressure on prices. While nowhere near as volatile as the natural gas market, the price of Brent crude oil also fell over the quarter, ending Q3 at $75 per barrel. The near-collapse of Credit Suisse, and the subsequent heightened fears of a global banking crisis, saw crude futures decline more than 10% in just three days through mid-March. Recession fears, as well as the uncertain path of reopening in China, also saw aggregate industrial metals post a moderate decline over the period.

The standout performer was gold, which returned 5.6% over the quarter. Despite widespread market volatility, gold had an underwhelming 2022, as investors seeking safe-haven assets instead opted for the US dollar. However, with the first signs that the dollar may have passed its peak (in terms of strength versus other major currencies), and the outlook turning towards one of a more traditional recessionary view, investors flocked back to the yellow metal through Q1.

Cash

Given the ongoing volatility in equity and fixed income markets, holding cash remained popular with some investors through the quarter. In the short-term, cash deposits insulate investors from the price volatility observed in other asset classes. However, in the long-term, the real value of cash deposits is eroded by inflation. We currently only hold cash for short-term tactical reasons or within lower risk strategies, where the risk profile dictates a need for a larger cash allocation. We recently increased exposure to our preferred money market fund across the lower risk strategies, as the fund offers a material yield uplift versus cash held on deposit.

Whitechurch Investment Team

Quarterly Review, Q1 2023

(Issued October 2023)

FP3529.06.04.2023

Click here to download a PDF Version of the Quarterly Review

Source: Financial Express Analytics. Performance figures are calculated from 01/01/2023 to 31/03/2022 net of fees in sterling. Unit Trust prices are calculated on a bid-to-bid basis OEICs, Investment Trust and Share prices are calculated on a mid to mid basis, with net income reinvested. The value of investments and any income will fluctuate and investors may not get back the full amount invested. Currency exchange rates may affect the value of investments.

Important Notes: This publication is approved by Whitechurch Securities Limited which is authorised and regulated by the Financial Conduct Authority. All contents of this publication are correct at the date of printing. We have made great efforts to ensure the accuracy of the information provided and do not accept responsibility for errors or omissions. This publication is intended to provide helpful information of a general nature and is not a specific recommendation to invest. The contents may not be suitable for everyone. We recommend you take professional advice before entering into any obligations or transactions. Past performance is not necessarily a guide to future performance. Investment returns cannot be guaranteed and you may not get back the full amount you invested. The stockmarket should not be considered as a suitable place for short-term investments. Levels and bases of, and reliefs from, taxation are subject to change and values depend on the circumstances of the investor.