Whitechurch Blog: For Long-term Investors, Cash May Not be King

27th July 2023

With the Bank of England (BoE) base rate at its highest level since 2008, and further rate hikes expected before the end of the year, the attractiveness of cash as an asset class has undoubtedly increased. This was reflected in data from earlier in the year, which showed that investors added £2.32 billion to UK money market funds (highly liquid ‘cash equivalent’ products) in May (Source: Morningstar). Over the same period, risk assets such as equities, bonds and property suffered net outflows of £1.18 billion. With the average 60:40 portfolio still significantly underwater after a bruising 2022, and the economic outlook somewhat uncertain, many clients will be wondering if cash is a better option.

Inflation

Inflation has dominated headlines, both at home and across other developed markets, for the last year and a half. Even after a significant fall last month, the UK Consumer Price Index (CPI) sits at 7.9% year-on-year, far more than the BoE’s 2% target. Cash as an asset class is generally assumed to be very low risk. However, over time the impact of inflation will erode the value of cash held on deposit - for every 1% of positive inflation, the purchasing power of money declines by the same amount. Using the example above, a cash investor would therefore require a 1% interest rate on deposit to offset the impact of every 1% of inflation. Clearly, with inflation so high, the risk of a ‘real terms’ fall in the value of cash held on deposit is high.

Time in The Market

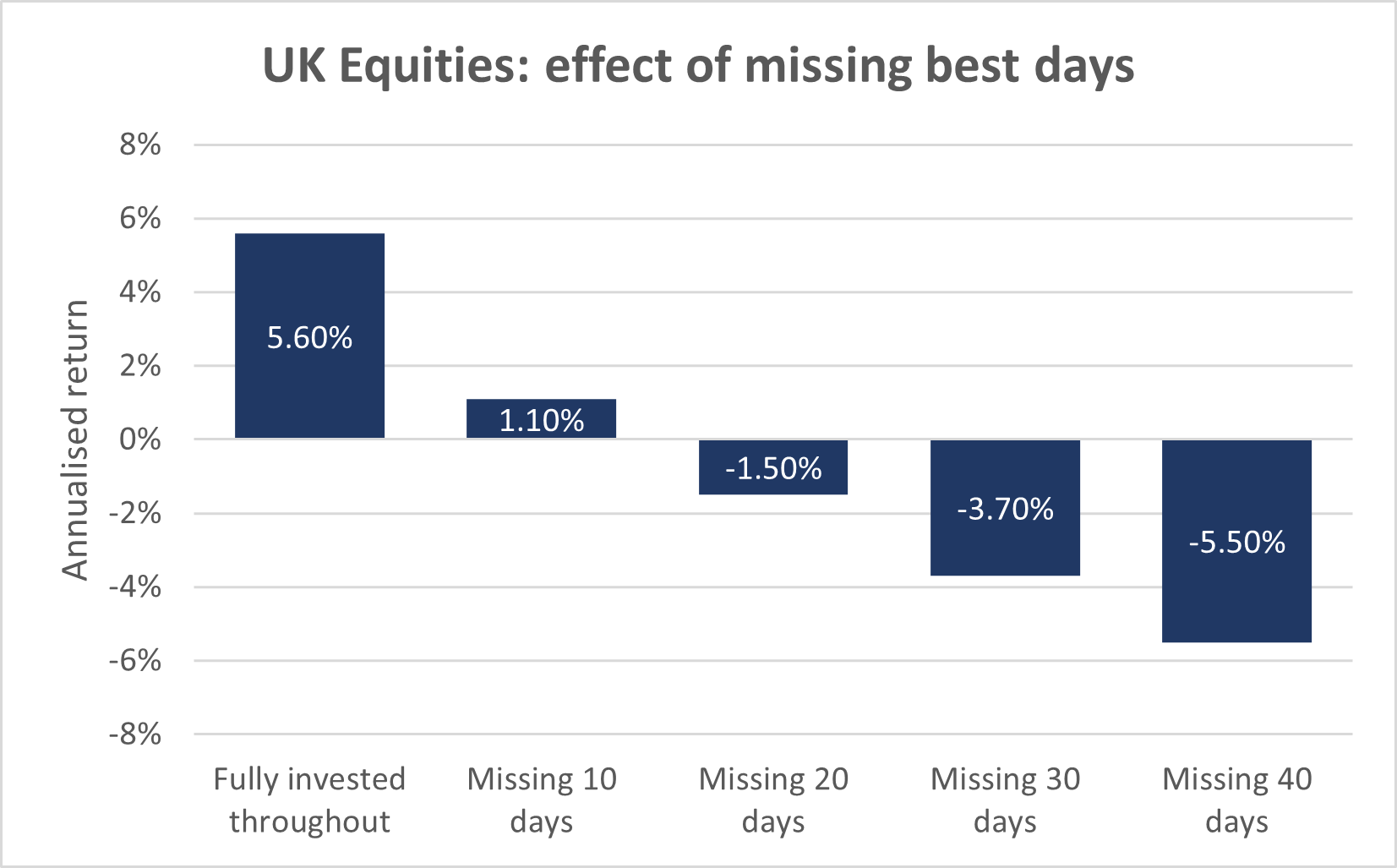

‘It’s about time in the market, not timing the market’ – the old saying is as relevant today as it has ever been. With volatility elevated and most asset classes suffering sharp swings in valuation, the temptation to try and time investments – to sell out at the top or ‘buy the dip’ – can be difficult to resist. But resist we must. While there will always be those that get lucky, the vast majority don’t. Even the world’s top investment banks, with their trillions under management and whole office blocks full of highly paid analysts, are generally unable to predict stock market movements with any degree of accuracy. Often, large gains follow large losses (see the market response to the COVID-19 pandemic as a classic example). It is also worth remembering that markets are forward-looking, and that can mean markets recover some time in advance of the wider economy. By attempting to time the market, investors risk missing out on some of the market’s best days. This can have a serious impact on long-term returns, as the chart below shows – missing the ten best days in the UK market over the last 15 years would have cut an investor’s annualised return by 4.5%!

While past performance can never be relied upon for predicting future returns, history suggests that investors are often rewarded for remaining invested during periods of market volatility. While the suitable level of exposure to risk assets will vary on a client-by-client basis and indeed, a very low appetite for risk may require no exposure whatsoever, equities and bonds have both tended to outperform cash over longer periods. As ever, a focus on the long term is essential. As a rule of thumb, equity investors should have a minimum five-year time horizon, and ideally longer still in order to maximise the likelihood of an attractive return. The chart below demonstrates the benefits of taking a long-term view - over the last 20 years, UK equities outperformed cash by 238%, and even after their worst year on record, bonds outperformed by 37%.

Looking Ahead

The last 18 months have been an incredibly challenging period for investors, and with interest rates still rising, the attractiveness of cash as an asset class has undoubtedly increased. However, history has shown that for those investors that can afford to wait, risk assets such as equities and bonds have tended to produce superior returns over the long term. While recent market turmoil has required an element of ‘holding one’s nerve’, periods of uncertainty inevitably bring opportunity, with many assets now trading at very attractive valuations – at present, we think this is particularly true of bonds. For our part, we maintain cash allocations only for liquidity purposes, or where the appetite for risk requires a lower level of volatility. Otherwise, we continue to favour broad diversification across asset classes and regions, to ensure that we are well-positioned for the long-term. As ever, for individual clients with questions related to their risk profile or investments more generally, we always recommend speaking to your adviser.

For information on our advisory services please visit our website www.whitechurch.co.uk or contact a member of our Client Services Team on:

Email: clientservices@whitechurch.co.uk

Phone: 0117 452 1208

FP3573.27.07.2023

Dr Daniel Say

Important Notes: This publication is approved by Whitechurch Securities Limited which is authorised and regulated by the Financial Conduct Authority. All contents of this publication are correct at the date of printing. We have made great efforts to ensure the accuracy of the information provided and do not accept responsibility for errors or omissions. This publication is intended to provide helpful information of a general nature and is not a specific recommendation to invest. The contents may not be suitable for everyone. We recommend you take professional advice before entering into any obligations or transactions. Past performance is not necessarily a guide to future performance. Investment returns cannot be guaranteed and you may not get back the full amount you invested. The stockmarket should not be considered as a suitable place for short-term investments. Levels and bases of, and reliefs from, taxation are subject to change and values depend on the circumstances of the investor.

Data Protection: Whitechurch may have received your personal data from a third party. If you invest through us, we may use your information together with other information for administration and to make money laundering checks. We may disclose your information to our service providers and agents for these purposes. We may keep your information for a reasonable period in order to manage your investment portfolios. We record telephone calls, to make sure we follow your instructions correctly and to improve our service to you through training of our staff. You have a right to ask for a copy of the information we hold about you and to correct any inaccuracies. When you give us information about another person you confirm that they have appointed you to act for them; that they consent to the processing of their personal data, including sensitive personal data and to the transfer of their information and to receive on their behalf any data protection notice.

Whitechurch Securities Limited is authorised and regulated by the Financial Conduct Authority. Financial Services Register No. 114318.

Registered in England and Wales 1576951. Registered Address: C/o Saffery Champness, St Catherine’s Court, Berkeley Place, Bristol, BS8 1BQ

Correspondence Address: The Old Chapel, 14 Fairview Drive, Redland, Bristol BS6 6PH Tel: 0117 452 1207 Web: www.whitechurch.co.uk