Whitechurch Investment Update: Quarterly Review - Q3 2021

18th October 2021

Click here to download a PDF Version of the Quarterly Review

Welcome to the Whitechurch quarterly investment review. This review covers the key factors that have influenced investment markets over the past quarter and the Whitechurch Investment Team’s current views and broad strategies being employed.

UK Equities

The UK market rose modestly over the quarter, as widespread supply chain disruption hampered the progress of economic recovery. The UK market delivered a return of 1% – its lowest level of quarterly growth since Q3 2020. Large and mid-cap stocks saw returns of 0.7% and 2.3% respectively while small companies achieved a return of 2%. On a sectoral basis, the strongest performance came from Energy (+11%), buoyed by a recovery in the price of crude oil throughout the period, as well as from cyclical areas of the market such as Industrials (+3.8%), Real Estate (+4%) and Financials (+0.6%). The notable laggards were Telecoms (-9.1%), Consumer Services (-3.8%) and Consumer Staples (-2.1%).

Following on from a positive second quarter for UK equities, Q3 began with investor sentiment towards the region in good shape. The so far successful vaccination programme continued to have the desired effect on reducing the number of virus-related hospitalisations despite the emergence of the ‘delta’ variant we referred to last time. As a result, July saw the UK government take the decision to move to step 4 of their so called ‘Roadmap’ – the final easing of lockdown restrictions. Other early tailwinds came from improving economic data and a stronger than anticipated corporate earnings season. The former included the continuation of encouraging Purchasing Managers’ Index (PMI) figures for both Manufacturing and Services, confirmation that the level of payrolled employment had recovered to beyond pre-pandemic levels and a general decline in the number of furloughed workers throughout the UK. This was further supported by the release of GDP figures, which showed the UK economy grew by 4.8% in Q2, broadly in line with the Bank of England’s estimate of 5%.

Last quarter we alluded to the active merger and acquisition (M&A) market, which has proved to be a prevalent theme throughout the UK’s recovery. In July we learned that UK M&A activity rebounded to record levels in H1 of this year, boosted by an increased hunger for transformational and disruptive technology businesses, as well as high profile targets such as Meggitt PLC and several of the leading supermarket chains. High levels of pent-up demand and consumer spending remained another trait throughout the period, however supply chain issues and staff shortages curtailed growth across multiple industries. One notable example where supply has failed to keep pace with demand is the automotive industry. A global shortage of semiconductor processing chips has led to a significant reduction of new vehicles, which in some instances pushed used car prices as much as 30% higher year-on-year. Other headwinds which impacted the supply of goods generally included the rising cost of raw materials, more post-Brexit red tape at borders and a national shortage of HGV drivers. The latter worsened as the quarter went on and eventually led to a shortage of petrol and diesel during September, as well as increased pressure on food retailers to reassure customers they were able to meet consumer demand.

Broadly speaking, it was still a relatively positive period for UK equities, outperforming all other major developed markets, with the exception of Japan. That said, the headwinds for equities in general, namely supply issues, the rate of economic expansion and rising inflation are likely to linger for some time. Towards the end of the quarter, the Bank of England voiced its concerns publicly, predicting that the level of inflation is now likely to peak above 4% before the end of the year and remain high until at least Q2 of 2022. Whilst doing so it also reiterated its intention to avoid taking action for the time being, with the Monetary Policy Committee opting to maintain its policy rate at historic lows.

Global Equities

Global equity markets delivered mixed returns during the quarter. On one hand the success of the global vaccination effort in suppressing hospitalisations allowed for further gains to be made, albeit tailing off towards the end of the quarter. However, global markets were also contending with a series of regulatory crackdowns in China. Firstly, new legislation largely aimed at the technology sector, has already seen large fines handed out to those firms deemed to be monopolising certain areas of the market, whilst the government also sought to rein in debt and bring prices under control in the property sector. Elsewhere, the looming prospect of the Federal Reserve (the Fed) tapering its asset purchases continued to provide uncertainty for equity investors, whilst the aforementioned UK themes such as rising inflation and supply chain worries can also be applied to equities more globally. That said, year to date gains in equity markets remain remarkable and the OECD forecast for full year global GDP growth has remained largely unchanged from the previous quarter, at 5.7%, with 4.5% projected for 2022.

As per the UK, the US market achieved a modest return, after gains made in July and August were largely rebuffed in September. The quarter started with a series of strong corporate earnings announcements, with all but financial and energy sectors delivering positive returns in July. US PMI for manufacturing reached a record high of 63.4, whilst markets received confirmation that second quarter US GDP grew by 6.5%, albeit behind expectations. Among August’s main contributors to performance were the financial and communication sectors, in what was another strong month for major indices. Economic data however, was beginning to reflect a more mixed picture, with both figures for retail sales and real estate transactions lagging forecasts, as well as US Services PMI reaching its lowest point since July 2020. The annual rate of US inflation remained near its highest level since 2008, at 5.3%.Whilst the Fed have indicated that inflation may be temporary, supply chain issues and a labour shortage weighed on investor sentiment towards the end of the quarter. September saw the Fed hint at plans to begin tapering asset prices from November during its new Summary of Economic Projections. Perhaps also rather telling was the Fed’s move to downgrade US GDP growth forecasts for 2021 from 7.0% to 5.9%, citing that the path of the economic recovery continues to be dependent on the course of the coronavirus and that risks remain despite the progress made with the vaccination effort thus far.

After a strong first half of the year, the recovery of European stocks slowed during Q3 despite significant vaccination progress. Notable performance came from those technology stocks benefiting from an increased demand for semiconductor processing chips, as well as the broader energy sector. Among the detractors was the luxury brands sector, which was impacted by fears that any wealth distribution policy amendments in China could hurt future demand. Much like in the UK and US, the period started positively, buoyed by a series of ahead-of-expectation corporate results announcements, yet slowly waned as the quarter progressed. Similar themes also increasingly weighed on investor sentiment throughout, namely supply chain worries and inflation. The latter gradually increased throughout the period, peaking at an estimated annual rate of 3.4% in September. The European Central Bank were quick to voice that “inflation is currently being pushed up largely by temporary factors that are expected to fade in the coming years”, announcing a reduction in the pace of asset purchasing. Further market uncertainty was provided by political tension in the run up to Germany’s parliamentary election and a surge in energy prices towards the end of the quarter – the latter brought on by a cocktail of political, supply and weather-related issues.

In contrast, Japanese equities experienced a strong quarter, returning more than any other developed region by some margin. Japan have been a major beneficiary of the increase in demand for exports born out of the broader global economic recovery. A resultant strong corporate earnings season, blighted only by sporadic disappointments such as Toyota Motor Corporation, boosted investor sentiment towards the region. It was also a busy quarter for Japanese politics, in a period which saw Prime Minister, Yoshihide Suga step down from his position of leader of the Liberal Democratic Party (LDP). Despite widespread criticism over his handling of the coronavirus pandemic and fading popularity with the Japanese public, the announcement still came largely as a surprise, particularly given the short (12 month) duration of his term. Instead, it will be Fumio Kishida who will lead the LDP into November’s general election. Whilst major changes to policy seem unlikely, the news has been largely well-received. Japan has thus far been slower out of the blocks to combat the spread of coronavirus and inoculate its population compared to other developed economies. However, the most recent figures showed both slowing case numbers and an improvement in vaccination uptake. Early indications from Kishida that additional fiscal stimulus to support the economy through the pandemic will be provided, also contributed to an improvement in investor optimism.

As with last quarter, Emerging Markets, in general, lagged developed markets. The aforementioned regulatory activity in

China was a cause for concern throughout the period, with the government looking to assert authority in both technology and property industries. The latter saw authorities seek to rein in debt and bring prices under control, with potential high profile casualty Evergrande Group struggling to clear some $300 billion of debt. Default for the group would not only spell disaster for China’s real estate sector, which accounts for circa 28% of its GDP, but would almost undoubtedly have a significant knock-on effect more systemically. Power and energy supply chain issues also impacted the wider Asian economy, with South Korea also experiencing a very poor quarter. In summary, in a reversal of fortunes from last year, Asian stocks (excluding Japan) are among the worst performers of 2021 to date. Unlike last quarter, Brazilian equities also weakened significantly, impacted by a series of interest rate hikes to combat excessive inflation. Under pressure industrial metal prices also limited growth for other South American nations, namely major exporters such as Chile and Peru. Broadly speaking, the best performing emerging markets during the period were those with a notable energy market, such as Russia and several Middle Eastern economies. India also bucked the trend for Asian markets with a strong period, akin to progress made against the spread of coronavirus. As at the end of the quarter, India had administered nearly one billion doses, more than double the US and second in the world only to China.

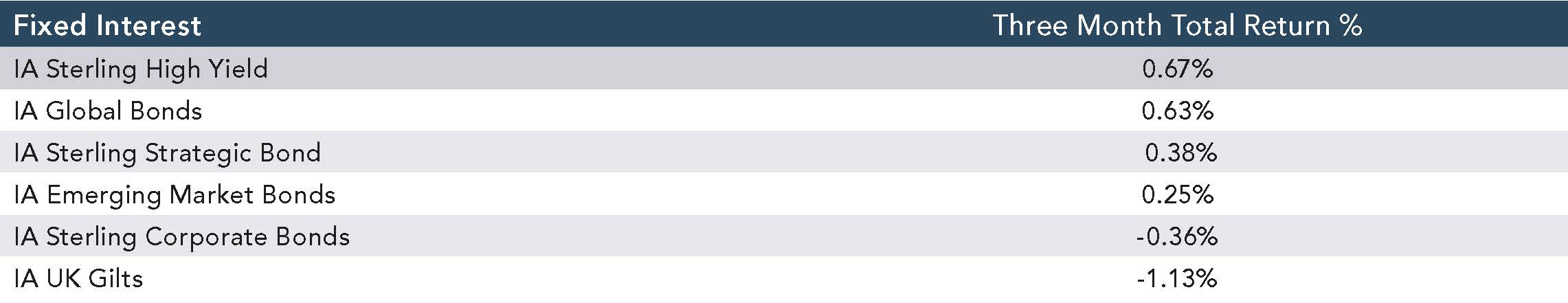

Fixed Income

It was another mixed quarter for government bonds. In the US and across Europe, yields initially declined during July and August as the pace of economic recovery slowed, before continued inflationary pressure and the prospect of lower monetary support saw yields recuperate as they sold off in September. Investors generally viewed the surge in government bond yields towards the end of the period as an opportunity to rotate away from typical growth companies, such as those in the technology sector, in favour of more cyclical stocks in the energy and financial sectors. The hawkish rhetoric from both the Fed and the Bank of England saw the yield of the UK 10-year Gilt finish the quarter 31 bps higher, at 1.02%, while the US 10-year Treasury yield increased fractionally to 1.49%. As we wrote last quarter, Fed Chair Jerome Powell’s view is that high inflation will be transitory due to the unique set of circumstances presented by the pandemic, and that any labour shortages will soon be ironed out. To reiterate our own view, while we accept that base effects are distorting the headline inflation figures, there are longer term underlying pricing pressures emanating from both demand and supply side issues and that this supports our positioning in index-linked bonds.

In general, corporate bonds outperformed government bonds, although the spread between the two did tighten over the course of the period. As with last quarter, high yield generally outperformed investment grade, as the lessened prospects of default amid the broader economic recovery continued to support the case for more risk. This has been highlighted by Fitch, who pointed out that the US high yield bond default rate declined further in September. This now makes it eight consecutive months of decline, finishing the period with a default rate of just 1%. They also expect that rate to continue to fall in the short term, specifically to 0.8% in early Q4 – the lowest level since February 2014. The last US default happened in July, when GTT Communications Inc. failed to meet its payments. Significantly this represented the longest period without default in a decade. Global convertible bonds (that is those with the embedded option to convert from debt to equity) behaved broadly in line with global equities, as expected. Positive returns made during July and August did not provide enough protection from a poor September, finishing the quarter marginally negative.

Commercial Property

UK direct property delivered another positive return this quarter. The emergence from a third national lockdown, along with continued vaccination progress and a gradual return to the workplace supported consumer confidence in the sector. Q3’s figures for the occupier market suggest that central London office take up at the end of H2 this year was comfortably at its highest level since the coronavirus outbreak, albeit still 17% below the 10-year average. Total occupier take up across nine of the largest UK cities remains 25% below the 10-year average and still very much remains dominated by city centre activity, as opposed to demand for out-of-town developments. Data from the UK property investment market was more encouraging, with provisional transaction volumes at the end of H2 this year just 1% below the 5-year average, surmounting the poor figures released six months prior. In our last review, we wrote that to date the bulk of the improvement in the property market has been concentrated in the industrial/logistics sector, as well as some alternative asset classes such as data centres and age care facilities, while demand remains subdued across the office and retail sectors. Data released this quarter indicates that this largely remained the case, with the increase in quarterly volumes in the industrial sector ending H2 54% higher than its 5-year average compared to office and retail space, which registered a 1% decline over the same period.

Commodities

It was a very strong quarter for the energy market, which drove the broader commodities sector to its largest annual gain since 1979. A significant increase in demand saw the wholesale natural gas market record a quarterly price gain in excess of 50%, or 135% year to date. The dramatic rise is down to a combination of both supply and demand factors, which have also spilled over into the wider energy market. The period also saw the strong run in the price of oil continue, with Brent Crude finishing the quarter over $78 per barrel for the first time since 2018, representing a gain of 4%. The price squeeze is also a result of the agreed series of output cuts by the OPEC+ group.

Unlike last quarter, the returns in the metal markets were generally poor. Despite a positive contribution from the price in aluminium, the prices of industrial metals, such as copper, lead and nickel, all declined during the period. Precious metals also provided negative returns, with the gold and silver prices moving 1% and 14% lower respectively. There was also a decline in the price of platinum (10%) and palladium (31%). Elsewhere, there were small declines for livestock, as well as agriculture more generally, with notable laggards such as soybeans and corn weighing on the sector.

Cash

With many bond yields still close to all-time lows, the opportunity cost of holding cash relative to bonds remained modest. In the short-term, cash deposits insulate investors from the price volatility seen in other asset markets. However, in the long-term, the real value of cash deposits is likely to continue to be eroded by inflation. We currently only hold cash for short-term tactical reasons or within lower risk strategies, where the risk profile dictates a need for a larger cash allocation.

Whitechurch Investment Team,

Quarterly Review, Q2 2021

(Issued July 2021)

FP3264.18.10.2021

Click here to download a PDF Version of the Quarterly Review

Important Notes: This publication is approved by Whitechurch Securities Limited which is authorised and regulated by the Financial Conduct Authority. All contents of this publication are correct at the date of printing. We have made great efforts to ensure the accuracy of the information provided and do not accept responsibility for errors or omissions. This publication is intended to provide helpful information of a general nature and is not a specific recommendation to invest. The contents may not be suitable for everyone. We recommend you take professional advice before entering into any obligations or transactions. Past performance is not necessarily a guide to future performance. Investment returns cannot be guaranteed and you may not get back the full amount you invested. The stockmarket should not be considered as a suitable place for short-term investments. Levels and bases of, and reliefs from, taxation are subject to change and values depend on the circumstances of the investor.