Whitechurch Blog: Your Financial MOT

8th March 2022

Click here to read our full Newsletter

There’s no time like the end of a tax year to conduct a financial MOT – to check that your investment strategy is still aligned to your objectives and to ensure that you are not paying too much to the tax man. The tax year ends on the 5th of April 2022. You have until then to make the most of your tax-free allowances that can’t be rolled over. To get you started we have compiled a list of key ‘hazard lights’ to check.

- Annual allowances

- Capital Gains Tax (CGT): £12,300

- Inheritance Tax (IHT): £325,000

- Pensions: £40,000

- Individual Savings Accounts (ISA): £20,000

- Junior Individual Savings Account (JISA): £9,000

For further information please see our Tax Rates Leaflet 2021 here or ask a us to post you a copy.

Investment Portfolios

With so much changing in the global economy and political world it is essential to have a forward-looking investment strategy; to regularly review your portfolio and to ensure that your investments are continually positioned to meet your goals.

Many portfolios and funds have made good gains over the last few years, despite the fall at the initial time of the Coronavirus pandemic. But this can lead to an investment having moved to a higher equity percentage and therefore a higher risk level. If you are that bit older, or approaching retirement, this may not be the most suitable positioning for your investment.

Regulation

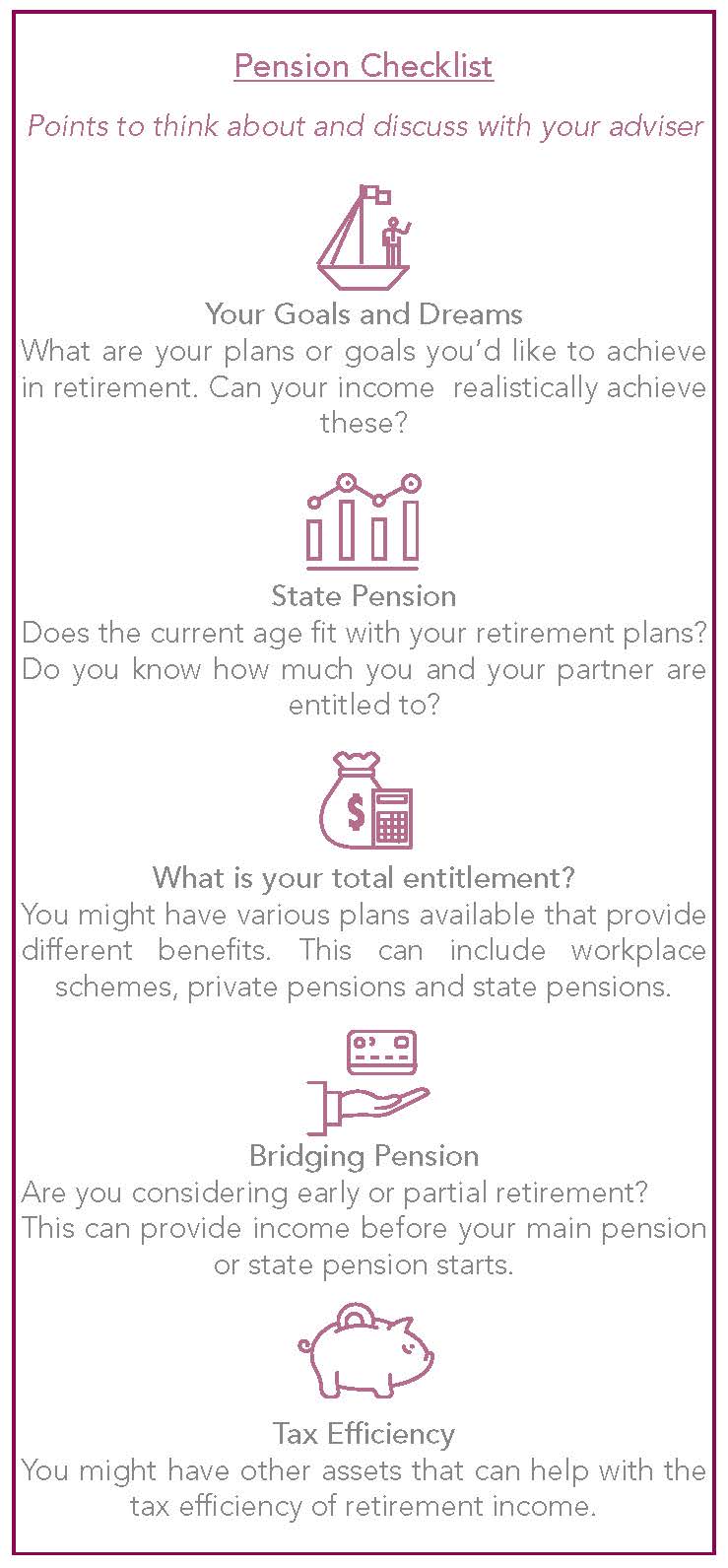

Do you have the most up to date pension plan? The age you can access your pension is increasing from 55 to 57 in 2028. This might affect your plans and requirements. This also highlights how pensions regulation frequently changes and your finances need to be prepared for further change in the future.

Taxation

Is there a possibility you might have other non-taxable income when you retire? For example, you might have an Individual Savings Account (ISA), General Investment Account (GIA), investment bond, or cash available to take money from, along with your pension.

Income

There are several factors that are important to consider when assessing what level of income you need. Firstly, is any income actually required? A professional adviser can calculate what a sustainable level of income is for your plans and what the most appropriate funds are to provide this. They can also help to be sure you aren’t paying unnecessary amounts of tax that could be avoided.

Secondly, when do you plan to retire? Have you

considered where your income will come from if you retire before the age you can receive income from your State or Defined Benefit pension? As noted above, you might have other income sources that could be sufficient to provide this amount, or an adviser could look to see if a form of ‘bridging pension’ is a solution.

Costs

Have you considered the costs and range of funds you currently have? You might want a professional to have a look if these are in-line with your needs both now and for any flexibility in the future. There may be costs associated with taking benefits from your pension or if you’re considering moving to a different plan if you want to change your options. However, it might be that the costs of switching pensions are less than those on an old style plan. It might be that a managed portfolio with fewer active strategies is more suitable for you due to their lower costs.

In summary, having an adviser check in on your retirement plans and current pension and other saving accounts that could provide possible income could enable you to have greater flexibility in the future and provide a better value for money plan.

If you would like an adviser to provide a financial or pension MOT please contact us:

Or By Phone: 0117 452 1208

FP3323.02.02.21

Important Notes: This publication is approved by Whitechurch Securities Limited which is authorised and regulated by the Financial Conduct Authority. All contents of this publication are correct at the date of printing. We have made great efforts to ensure the accuracy of the information provided and do not accept responsibility for errors or omissions. This publication is intended to provide helpful information of a general nature and is not a specific recommendation to invest. The contents may not be suitable for everyone. We recommend you take professional advice before entering into any obligations or transactions. Past performance is not necessarily a guide to future performance. Investment returns cannot be guaranteed and you may not get back the full amount you invested. The stockmarket should not be considered as a suitable place for short-term investments. Levels and bases of, and reliefs from, taxation are subject to change and values depend on the circumstances of the investor.Data Protection: Whitechurch may have received your personal data from a third party. If you invest through us, we may use your information together with other information for administration and to make money laundering checks. We may disclose your information to our service providers and agents for these purposes. We may keep your information for a reasonable period in order to manage your investment portfolios. We record telephone calls, to make sure we follow your instructions correctly and to improve our service to you through training of our staff. You have a right to ask for a copy of the information we hold about you and to correct any inaccuracies. When you give us information about another person you confirm that they have appointed you to act for them; that they consent to the processing of their personal data, including sensitive personal data and to the transfer of their information and to receive on their behalf any data protection notice.

Whitechurch Securities Limited is authorised and regulated by the Financial Conduct Authority. Financial Services Register No. 114318.

Registered in England and Wales 1576951. Registered Address: C/o Saffery Champness, St Catherine’s Court, Berkeley Place, Bristol, BS8 1BQ

Correspondence Address: The Old Chapel, 14 Fairview Drive, Redland, Bristol BS6 6PH Tel: 0117 452 1208 Web: www.whitechurch.co.uk